Planning for the future doesn’t come naturally to any of us. We understand why it gets put off for another day.

Starting

With something so alien, it can be difficult to know where to start

Language

Financial language can be impenetrable, with unfamiliar terms

Picture

We only know work life and can't clearly picture what we’ll do in our retirement

Worry

It’s stressful trying to work out how much money you’ll have to actually live on

We’re trusted to take care of your future

Pension Potential is authorised and regulated by the Financial Conduct Authority.

We employ bank level security with your personal information.

Secure

Protected

Innovative

Recognised

Best Rate

How does Pension Potential work?

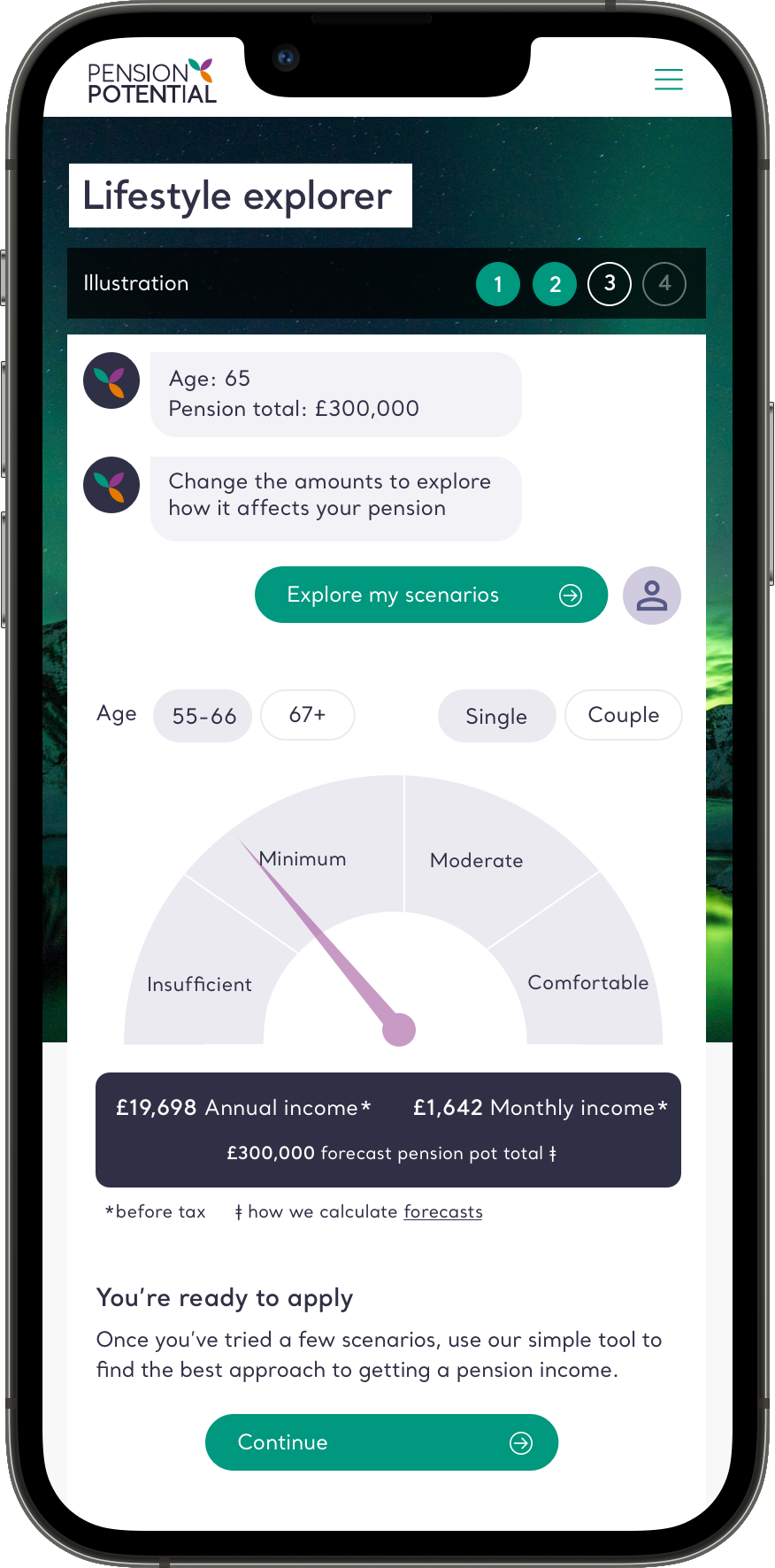

Rapid assessment

Using our simple chat, we collect the minimum amount of information to offer the best approach depending on your pension amount and lifestyle attitudes.

Personalised approach

We clearly explain your plan with specific amounts alongside useful content to put you in control. Download your own advice report, then re-join your journey when you’re ready.

Convenient video calls

Once you’ve completed the basics, our experts will guide you through your plan, answering any questions you have – and all in plain language, to get your plan up and running in no time.

Help making the right decision

Help making the right decision

We know how important your pension decisions are.

From deciding on your specific strategy to investment choices, we’re there to get it right with you by:

- Making sure we take care of the cost of living first and foremost in your approach

- Creating a plan for your entire retirement, based on actual life expectancy, so you don’t run out of money

A time for enjoyment and relaxation

A time for enjoyment and relaxation

Investments, by their very nature, can be complex.

We recognise that many people want to focus on enjoying life, not spending time on complex finance matters.

- Our experts work with you to get everything set up once

- You can be confident that your plan is the right approach for your whole retirement

Making the complex straightforward

Making the complex straightforward

Pension plans, investments and finance management are so intricate, it can feel like only those with in-depth knowledge can engage with their retirement ahead of doing so.

- We provide clear 'what you need to know' checklists – all understandable without needing any background in finance

- We help you envisage your retirement, showing you what you need for the everyday and for the big things you want to do